Double Entry for Dividend

As per Finance Act 2020 from April 1 2020 dividends are taxable in the hands of recipient investorsshareholders. A double bottom is a charting pattern used in technical analysis.

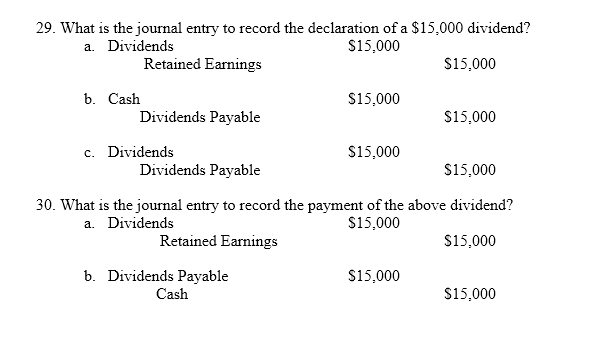

Solved 29 What Is The Journal Entry To Record The Chegg Com

Now heres the bonusthe double double Tim Horton and I both went to St.

. In double entry accounting the total of all debit entries must match the total of all credit entries. When this happens the transaction is said to be in balance If the totals do not agree the transaction is said to be out of balance and you will not be able to use the resulting information to create financial statements until the transaction has been corrected. No97-28 97th Cong 2d Sess.

In the past the population grew slowly. Used in a double-entry accounting system journal entries require both a debit and a credit to complete each entry. As the growth rate slowly climbed the population doubling time fell but remained in the order of centuries into the first half of the 20th century.

Transmitted by the President of the United States of America to the Senate September 14 1982 Treaty Doc. No other investment services provide you. It describes the drop of a stock or index a rebound another drop to.

The entry box will be at sponsor stores each day starting at 10am. So when you buy goods it increases both the inventory as well as the accounts payable accounts. To do so the parent company enters a debit to the dividends receivable account and a credit to the investment in subsidiary account on the business day after the record date.

They provide important information that are used by auditors to analyze how financial. Things sped up considerably in the middle of. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable.

The list represents. CAGR on dividends. At the date of declaration the business now has a liability to the shareholders to be settled at a later date.

Get Ready once again its time to Double Your Dividend and you can win with the KSRM Radio Group. Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position. Every entry to an account requires a corresponding and opposite entry to a different account.

If youre looking for cheap dividend stocks and frustrated by the lack of options check out the following list of 15 picks under 15. In 2019 Larson declared and paid dividends of 4000. Reported favorably by the Senate Committee on Foreign Relations.

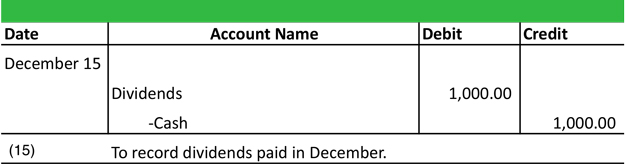

Journal entries are the foundation for all other financial reports. Outstanding stock of the Larson Corporation included 40000 shares of 5 par common stock and 10000 shares of 5 10 par noncumulative preferred stock. The credit entry to dividends payable represents a balance sheet liability.

Movement on the retained earnings account. Learn how to make money with this list of excellent dividend-paying companies and get expert ideas on making the most of your income investments. Movement on the Retained Earnings Account.

The parent company reports the effects of this transaction on its. After a decade the average yield on original cost of Connolly Report stocks was 81 eight point one beats the market with out counting capital gains. Double entry bookkeeping Double Entry Bookkeeping Double Entry Accounting System is an accounting approach which states that each every business transaction is recorded in at least 2 accounts ie a Debit a Credit.

It took nearly seven centuries for the population to double from 025 billion in the early 9th century to 05 billion in the middle of the 16th century. When the subsidiary pays a dividend the parent company reduces its investment in the subsidiary by the dividend amount. At the same time as the dividend is declared the business will have decided on the date the dividend will be paid the dividend payment date.

Thats a consistent return which means using the rule of 72 I double my portfolio every 6 years. Double-entry bookkeeping also known as double-entry accounting is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Also for dividend income paid in excess of Rs 5000 from a company or mutual fund 10 TDS will be applicable.

After the closing journal entry the balance on the dividend account is zero and the retained earnings account has been reduced by 200. The double-entry system has two equal and corresponding sides known as debit and credit. The movement on the retained earnings account as a result of the closing journal entries is summarized in the table below.

This is an interesting fact that although they. My approach is simple but you need key data that I have cultivated with the Dividend Snapshot Screeners. In 2020 Larson declared and paid dividends of 12000.

Furthermore the number of transactions entered as the debits must be equivalent to that of the credits. DOUBLE TAXATION TAXES ON INCOME CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND AUSTRALIA Convention signed at Sydney August 6 1982. Technically you can consider the below as the best TSX dividend stocks now for an entry point.

Look into dividend growth. If the dividend goes up Mr Clement the yield rises too. Listen for the location of the day Monday through Saturday on KSRM 920AM KWHQ 1001 FM KKIS 965 FM KSLD 1140AM KFSE 1069FM and KKNI 1053 FM then go and register.

How much of the 2020 dividend was distributed to preferred shareholders.

Dividends Declared Journal Entry Double Entry Bookkeeping

Journal Entries Examples Format How To Explanation

Calculating Dividends Recording Journal Entries Youtube

Dividends Payable Classification And Journal Entry Debit Credit

No comments for "Double Entry for Dividend"

Post a Comment